When you’re the sole operator of your business, a single member LLC might help safeguard you from liability for business enterprise obligations. Learn more about the benefits of a single-member LLC and the way to established just one up.

Though LLCs and firms each have some analogous attributes, The essential terminology frequently connected to Each and every type of lawful entity, at least inside the United States, is typically diverse. When an LLC is formed, it is said to be "arranged", not "included" or "chartered", and its founding doc is likewise known as its "article content of Business", in lieu of its "article content of incorporation" or its "company charter". Inner operations of the LLC are further governed by its "running arrangement", a "member", as an alternative to a "shareholder.

Detect a registered agent to stand for your LLC. It is possible to appoint a 3rd-bash business enterprise or self-designate to get lawful documents in the lawsuit as your registered agent.

As an example, to be suitable for your nonprofit LLC, your Corporation wants a general public mission, limitations on financial gain distributions, limited ownership and ought to stick to nonprofit laws set up from the state wherein it’s integrated.

It stops its entrepreneurs from remaining held personally liable for the debts from the company. In case the company goes bankrupt or is sued, the personal belongings of its operator-investors cannot be pursued.

No matter member and administration composition, LLCs are incorporated in a particular condition but can function nationally. Each condition might have its personal principles relating to LLCs, but the general authorized construction is the same no matter which point out you utilize to include.

Underneath partnership tax cure, Just about every member on the LLC, as is the situation for all companions of a partnership, on a yearly basis receives a Form K-one reporting the member's distributive share in the LLC's profits or reduction that is definitely then described around the member's specific profits tax return.[25] On the other hand, earnings from firms is taxed 2 times: as soon as at the corporate entity stage and again when distributed to shareholders. So, much more tax price savings normally final result if a business formed as an LLC as opposed to a corporation.[26]

Own asset protection. An LLC gives its owner or entrepreneurs with limited liability. Because of this implies you—the LLC operator—are normally not Individually answerable for any debts incurred by your LLC company or most enterprise-linked lawsuits.

Collection LLCs are only recognized in 19 states and therefore are very best for anyone wanting to guard many business property from the liability of another employing their particular LLC entities, such as the following:

These extra facts make it possible for our attorneys to get a deeper comprehension of the details of your respective situation

One other associates within a supervisor-managed LLC are passive investors that are not involved with small business discover this functions. This form of management could possibly be appealing for large LLCs with numerous users, or in which some members only wish to be passive buyers in the small business.

An LLC is member-managed when users take care of the small business themselves. These users can act on the company's behalf so long as they adhere to your operating arrangement.

A limited liability company (LLC) is a well-liked company construction combining each the liability safety of an organization and pass-by way of taxation of the partnership. A single benefit of an LLC is the flexibility it offers concerning administration and ownership composition.

But some states are more expensive than Other people. If you are not sure no matter if an LLC is worth it, get information from a lawyer as well as a tax adviser.

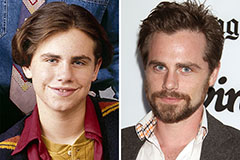

Rider Strong Then & Now!

Rider Strong Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Tina Majorino Then & Now!

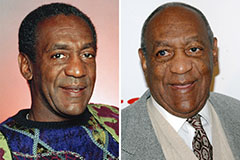

Tina Majorino Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!